Story Behind the IPO

Exclusive Reports

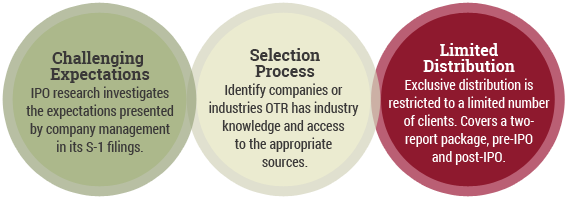

OTR's (Initial Public Offering) IPO reports cover the strengths, structure and the evaluation of growth strategies and potential risks related companies with upcoming IPOs. OTR's exclusive IPO reports provide timely company information before a stock becomes publicly traded and is monetized for private investors.

Quiet Period

During this time, issuers, company insiders, analysts, and other parties are legally restricted in their ability to discuss or promote an upcoming IPO. Most companies undertaking an IPO do so with the assistance of an investment banking firm acting in the capacity of an underwriter. Because OTR has no investment banking relationships and is not restricted by any company’s quiet period, the firm can provide unbiased intelligence at any time prior to the IPO.