Agriculture. Industrials. Energy. Transportation.

The Cyclicals group focuses on industries that present significant investment opportunities, serve as leading economic indicators and offer insight into local, regional and worldwide developments in four distinct areas: agriculture, industrials, energy and transportation.

OTR Global's soucrces contributing to Cyclicals research topics are based in Argentina, Brazil, Canada, Chile, China, France, Germany, India, Italy, Poland, Russia, Spain, Ukraine, the United Kingdom, and the United States.

Agriculture: Agriculture sources include farmers, dealers, wholesale distributors, agriculture executives and other industry specialists.

- Crop Inputs: Observe global agriculture trends, including supply, demand, pricing, market share and forecast spending levels for crop inputs.

- Farm Equipment: Assess current and forward-looking order trends, including lead times, inventory levels, incentive activity, pricing and market-share shifts.

Industrials: Industrials sources include heavy equipment dealers, used equipment specialists, wholesale and retail distributors, contractors, leasing executives, mining executives and other industry specialists.

- Construction & Mining Equipment: Forecast annual global equipment sales and rental trends by assessing dealer order patterns, auction metrics, contractor backlogs and mine operator capital expenditure (CAPX) plans.

- Nonresidential Construction: Assess current and projected construction trends, including booking forecasts, contract lettings, book-to-bill ratios, as well as financing and labor availability.

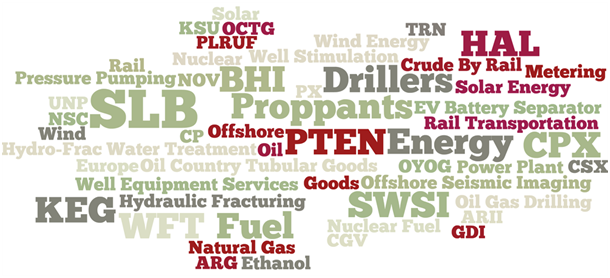

Energy: Energy sources include supply chain executives, proppant supply managers, railroad executives, pressure pump groups, E&P completion managers, engineers, transload executives, drilling contractors, and other industry specialists.

- Pressure Pumping & Well Completions: Provide insight on pressure pumping and completions spending levels, pricing, rig counts, and service group preferences.

- Proppant Supply Chain: Monitor and track developments including sand volumes and capacity, pricing and mesh size trends.

Transportation: Transportation sources include component suppliers, fleets, dealers, rail shipping executives, railcar leasing executives, shipping carriers, crude carriers, shipping brokers and other industry specialists.

- Heavy-Duty Trucks & Engines: Provide insight into heavy-duty truck and engine purchase plans by analyzing fleet operators' purchase plans and demand at the dealer and component supplier levels.

- U.S. Inland Tank Barge Shipping: Monitor trends affecting spot and term rates, as well as overall barge utilization trends.

- Rails: Assess factors affecting rail shipping, including rate trends, modal shifts and freight volumes, as well as monitor rail-car lease rates, and rail fleet spending plans.

Cyclicals sources include equipment dealers, equipment buyers, sales managers, farm managers, engineers, purchasing directors, corporate executives, directors, product managers, marketing managers, fleet managers, logistics managers, supply chain managers, mine managers, business development managers, transportation executives, shipping executives, construction company executives, production superintendents, operations managers and other top industry executives.

Cyclicals sources include equipment dealers, equipment buyers, sales managers, farm managers, engineers, purchasing directors, corporate executives, directors, product managers, marketing managers, fleet managers, logistics managers, supply chain managers, mine managers, business development managers, transportation executives, shipping executives, construction company executives, production superintendents, operations managers and other top industry executives.

Energy. Drilling Services. Pressure Pumping and Well Completions. Proppant Supply Chain. Solar Power

Energy industry sources include land drillers, E&P operators in shale regions, VP’s of exploration, technical sales, pressure pumpers, tubular steel buyers, frac sand mines, equipment buyers, transloaders, sales managers, production superintendents, operations managers and other top industry executives and experts located in Canada, China and the United States.